Overview of Private Company Mergers

Mergers are among the most powerful strategic tools businesses can use to scale, diversify, or consolidate. A well structured merger can allow companies to capture new markets, integrate supply chains, or gain proprietary technologies. However, private mergers require thorough due diligence, precise structuring, and a deep understanding of regulatory and tax implications. This guide explores the mechanics, common structures, tax issues, and legal best practices that shape private mergers.

What is a Private Merger?

A private merger involves the combination of two privately held companies into a single entity. These transactions can be structured in several ways, most often as a “forward merger”, “forward triangular merger”, or a “reverse triangular merger”. Mergers of private companies often involve fewer shareholders, requiring careful consideration of shareholder rights and expectations, as well as thorough due diligence to ensure all potential liabilities are discovered.

Types of Merger Structures

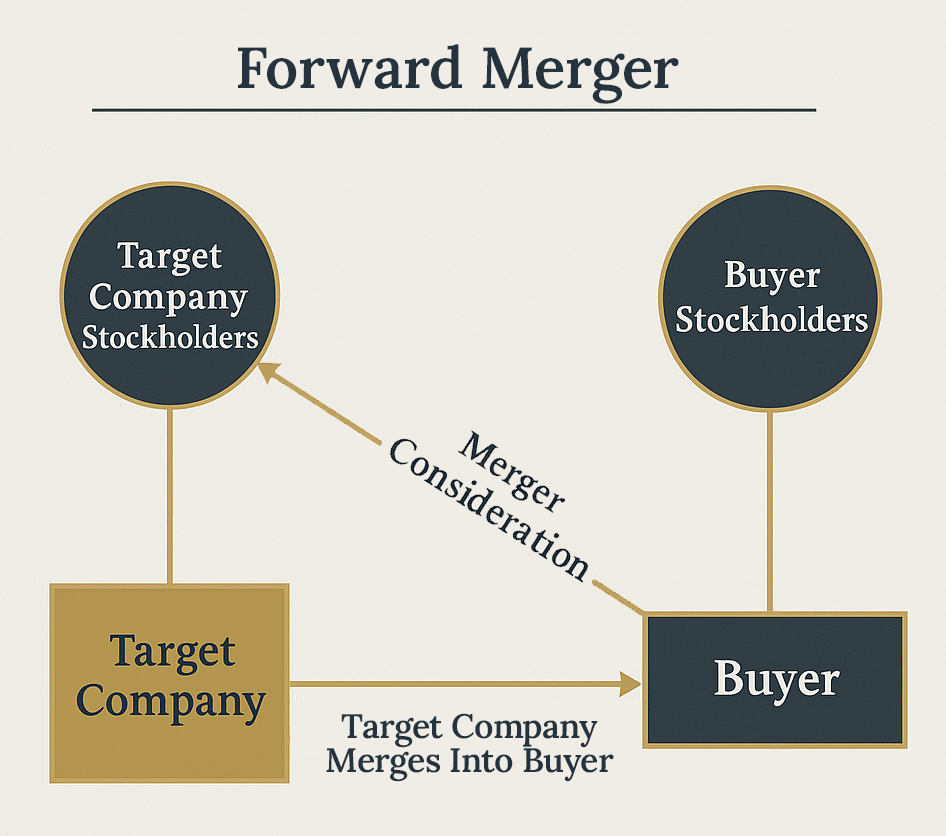

Forward Merger

In a forward merger, the target company merges directly into the buyer and the buyer assumes all assets, rights, and liabilities of the target. From a legal perspective, this is a simple merger structure, but can expose the buyer to unforeseen liabilities where the target company may have exposure. It’s often used when the buyer and target are related or known to each other, and the buyer has a deeper understanding of the target’s legal and financial history.

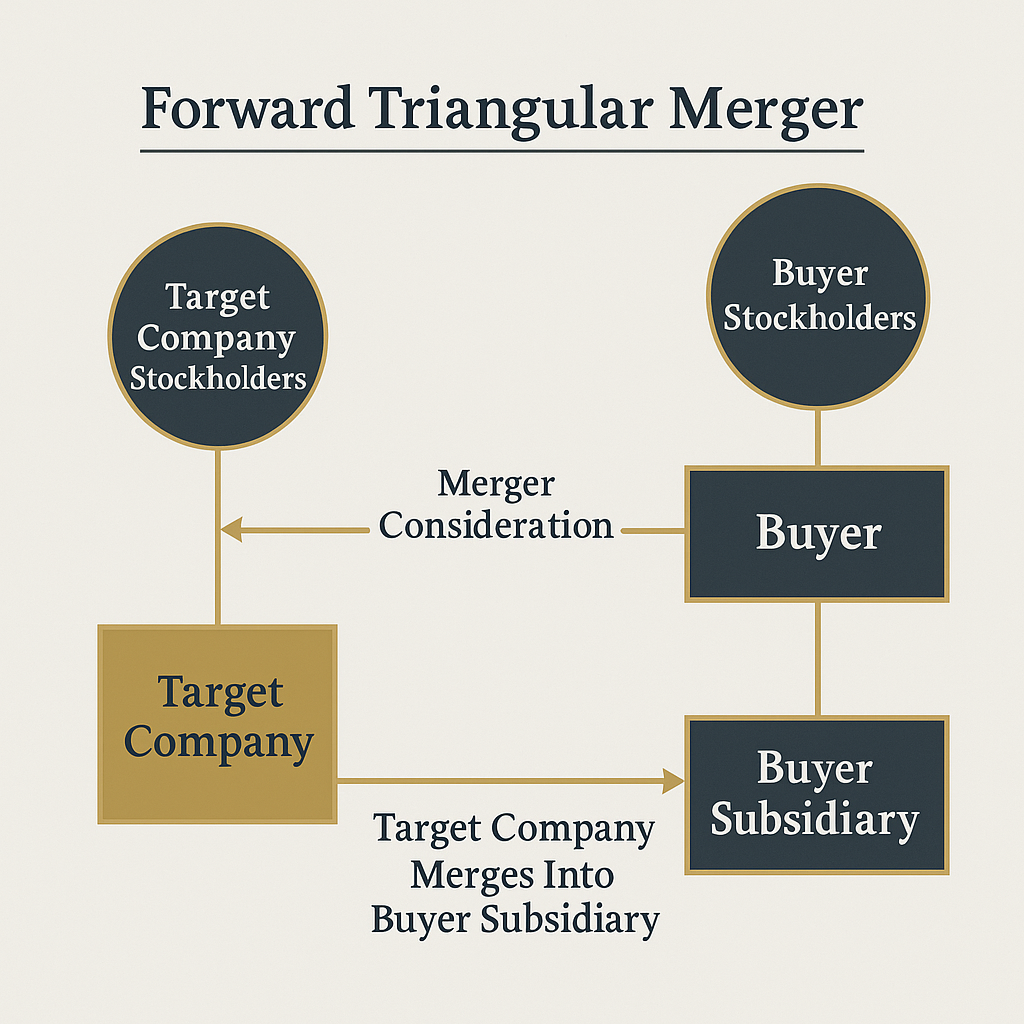

Forward Triangular Merger

Here, the buyer creates (or uses an existing) subsidiary company, which the target company is merged into. The subsidiary then “survives” the merger, acting as the operating company post-merger, and the target company is dissolved. Dissolution provides a layer of liability protection for the buyer by shedding any unknown liabilities, and may also provide tax benefits to the buyer in certain circumstances.

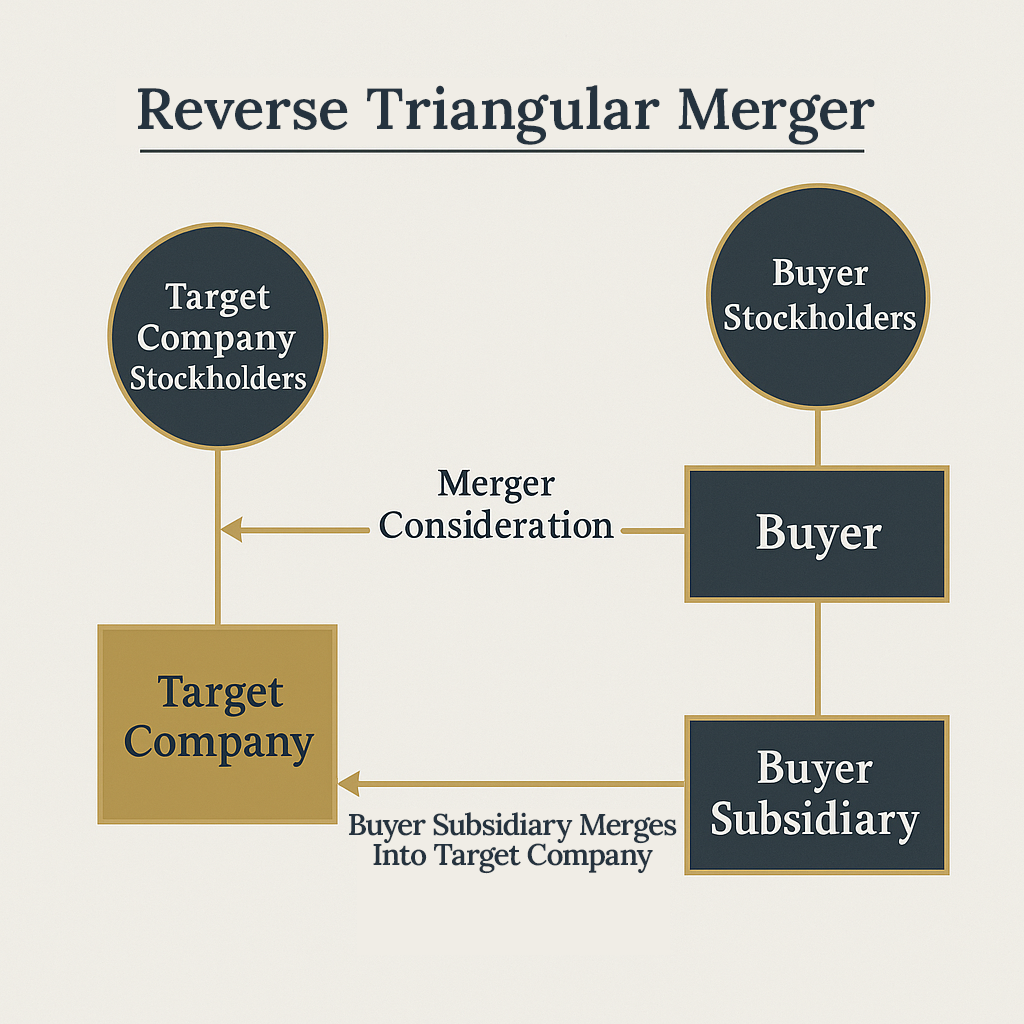

Reverse Triangular Merger

In a reverse triangular merger, the buyer’s subsidiary merges into the target company (rather than the target company into the subsidiary, as with a forward triangular merger), and the target company survives post-merger. This allows the target to retain its contractual relationships, permits, and licenses with minimal disruption, and avoids many transfer tax implications. This structure is widely used for maintaining business continuity post-merger.

Commercial and Legal Considerations

The commercial rationale behind mergers often includes expanding market share, eliminating competition, or acquiring proprietary assets. But legal and regulatory considerations are equally critical. Buyers must evaluate:

- Potential successor liability.

- Third-party consents on material contracts.

- Antitrust risks under applicable Federal law.

- Employment agreements and benefit plan obligations.

- Environmental liabilities and compliance obligations.

Tax Treatment of Mergers

Tax planning is vital in merger structuring. Forward mergers and forward triangular mergers are generally treated as asset sales, potentially resulting in double taxation—once at the corporate level and again at the shareholder level. However, they provide a stepped-up basis in assets, offering depreciation benefits.

In contrast, reverse triangular mergers are typically treated as stock sales, resulting in a single level of taxation. The buyer acquires stock and inherits the target’s existing asset basis. A Section 338(h)(10) election can allow a reverse merger to be treated as an asset sale for tax purposes, delivering a stepped-up basis while avoiding double taxation in certain conditions.

Pre-Merger Planning and Documents

Effective mergers require thoughtful pre-transaction planning. Critical documents often include:

- Term Sheets: Outline preliminary deal terms including valuation, consideration structure, and exclusivity.

- Confidentiality Agreements: Protect proprietary information during discussions and diligence.

- Exclusivity Agreements: Prevent the target from engaging with other suitors during the diligence process.

Due Diligence

Due diligence is the cornerstone of risk management in mergers. It enables the buyer to assess:

- Target’s capitalization and share ownership.

- Outstanding liabilities and contingent obligations.

- Material customer and vendor contracts.

- Compliance with regulatory regimes (e.g., employment law, environmental regulations).

Regulatory and Corporate Approvals

Private mergers must navigate multiple levels of approval. These include:

- Board and shareholder consents from both the buyer and target.

- Regulatory filings with federal and state agencies, especially under antitrust law.

- Contractual consents, especially for contracts with change-of-control or anti-assignment clauses.

Merger Agreement & Ancillary Documentation

The merger agreement is the definitive legal document governing the transaction. It outlines key provisions such as:

- Structure and consideration (cash, stock, earn-outs).

- Representations and warranties from both sides.

- Pre-closing and post-closing covenants.

- Conditions precedent and closing mechanics.

- Indemnification terms and escrow arrangements.

Other key documents may include escrow agreements, shareholder consents, employment agreements, and certificates of merger.

Post-Closing Integration

The real success of a merger often lies in effective post-closing integration. This includes:

- Onboarding employees and aligning HR policies.

- Integrating IT systems and data infrastructure.

- Consolidating financial reporting and payroll.

- Revisiting customer contracts and vendor relationships.

Representation & Warranty Insurance (RWI)

To reduce indemnity disputes and close deals faster, parties may obtain RWI coverage. This insurance covers breaches of representations and warranties, allowing sellers to minimize holdbacks and buyers to protect themselves from post-closing surprises.

Final Thoughts

Mergers are intricate business transactions requiring coordination across legal, tax, HR, and operational teams. Whether a forward merger or a reverse triangular merger, each structure comes with trade-offs related to risk, taxation, and administrative burden. A proactive approach to due diligence, regulatory compliance, and integration planning can significantly enhance the probability of a successful transaction.

Legal Disclaimer: This blog post is for general educational purposes only and does not constitute legal or tax advice. For assistance tailored to your business transaction, please consult Cantrell Law Firm.